Medenta

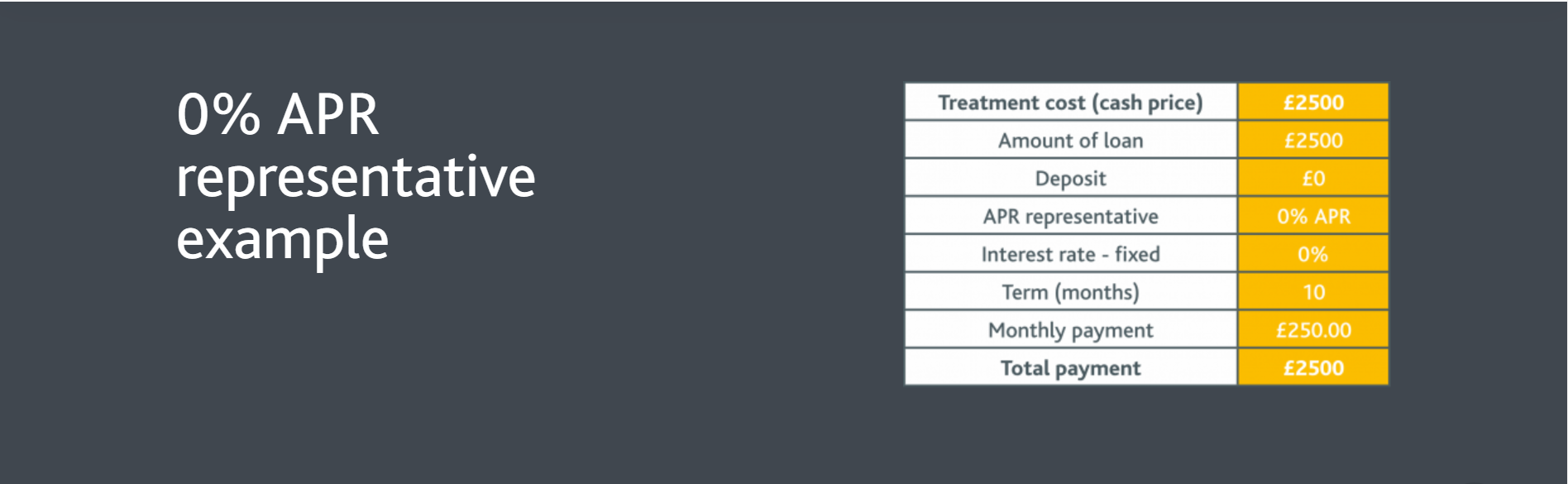

At the practice, we can provide access to two finance options that allow you to spread the cost of treatment over six or ten months, making it more affordable*.

Sound interesting? Read on to find out more!

*Options may vary from practice to practice. Speak to your practice for more information.

Your questions answered!

We’ve tried to answer the most commonly asked questions here, but if there’s anything else you’d like to know, please speak to a member of the team.

Who can benefit?

Almost anyone, if you are over 18, below 80

and a UK resident, subject to status and usual credit checks. You don’t have to belong to a membership plan and you don’t need to be a regular visitor at this practice. Access to facilities will be subject to an online credit application.

What can I use it for?

You can use our finance options for just about any treatment we provide, although they’re particularly suited to cosmetic, restorative, orthodontic and dental implant treatments.

Please ask a member of the team for more details.

What’s the minimum and maximum I can finance?

Our range of finance facilities cover any treatment which costs over £500* and up to a maximum of £50,000.

How do I make the repayments?

Much like any other finance facilities, you repay them in monthly payments over an agreed term.

These payments are collected by Direct Debit.

How much will I pay?

With our facilities, you pay the cost of your treatment – no more, no less. We can provide you with a quotation that shows the monthly payment over the term of the loan. There are no hidden costs and an upfront deposit isn’t always necessary.

What are the repayment terms?

Designated members of the practice team will be able to go through the terms so you can decide which option is appropriate for you.

How do I apply?

Once your treatment plan and costs have been agreed, you’ll be able to complete an easy-to-use online credit application.

How long does approval take?

The application takes just a few minutes to complete and the decision is given instantly.

If your application is approved, we can schedule treatment following the mandatory 14-day ‘cooling-off’ period.

Who is the credit provider?

The dental practice and Medenta Finance Limited are credit brokers and not lenders.

All credit is provided by Wesleyan Bank

Limited which acts as the lender. Wesleyan Bank and Medenta Finance Limited are part of the Wesleyan Group of companies.

For more information about the Wesleyan Group of companies, visit www.wesleyan.co.uk/legal-disclaimer

What if the cost of treatment changes?

We will let you know as soon as the situation arises. Should treatment costs increase, you can, depending on the amount, choose to have an additional finance option to cover the extra costs, subject to further credit status and affordability checks. If costs decrease, options can be discussed with the credit provider.

How often can I use the facility?

You can apply for finance for each course of treatment, subject to the usual credit check.

The advantages at a glance

For anyone considering using finance facilities to fund their private treatment, the advantages are clear:

- Makes treatment more affordable – by allowing you to spread the cost, you can opt to have the treatment you want, when you want it.

- Greater choice of treatments – by making treatments more affordable, you can access a wider range of treatments and choose the one perfect for you.

- Payment terms to suit you – with an option available of 24, 36 or 48 months you can choose the one best suited to your circumstances.

- No upfront deposit option* – with the choice to opt for no initial financial outlay, you can avoid dipping into your savings or having to find a lump sum to start your treatment.

*Options may vary from practice to practice, for example, term, product, lending level and deposit. Speak to your practice for more information

For more information please click the link HERE

57 Dental Care, 57 Bradford Road, Cleckheaton, BD19 3LB. Telephone 01274 872221. Sanna Khan and Temur Khan trading as 57 Dental Care is a credit broker not a lender and is authorised and regulated by the Financial Conduct Authority, 928072.

Where required by law, loans will be regulated by the Financial Conduct Authority and the Consumer Credit Act 1974.

Medenta Finance Limited, authorised and regulated by the Financial Conduct Authority No: 715523. Registered in Scotland, No: SC276679. Registered address: 50 Lothian Road, Festival Square, Edinburgh, EH3 9WJ. Tel: 01691 684175. Medenta act as a credit broker, not the lender and will introduce businesses to V12 Retail Finance Limited for which they will receive a commission. The amount of commission will vary depending on the product chosen and amount borrowed.

V12 Retail Finance Limited is authorised and regulated by the Financial Conduct Authority. Registration number:679653. Registered office: Yorke House, Arleston Way, Solihull, B90 4LH. Correspondence address: 25-26 Neptune Court, Vanguard Way, Cardiff, CF24 5PJ. V12 Retail Finance Limited act as a credit broker, not a lender, and only offers credit products from Secure Trust Bank PLC for which they will receive a commission, the amount will vary depending on the amount of credit taken out but will not vary depending on the product chosen. Secure Trust Bank PLC trading as V12 Retail Finance is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registration number: 204550. Registered office: Yorke House, Arleston Way, Solihull, B90 4LH.

Terms and conditions apply. Written quotations are available on request from Secure Trust Bank PLC. Credit facilities are subject to status and affordability checks and only available to UK residents over the age of 18. Secure Trust Bank PLC reserves the right to decline any application. APR and repayment details are correct at time of publish.

Telephone calls are recorded for training and compliance purposes.